direct deposit owner's draw quickbooks

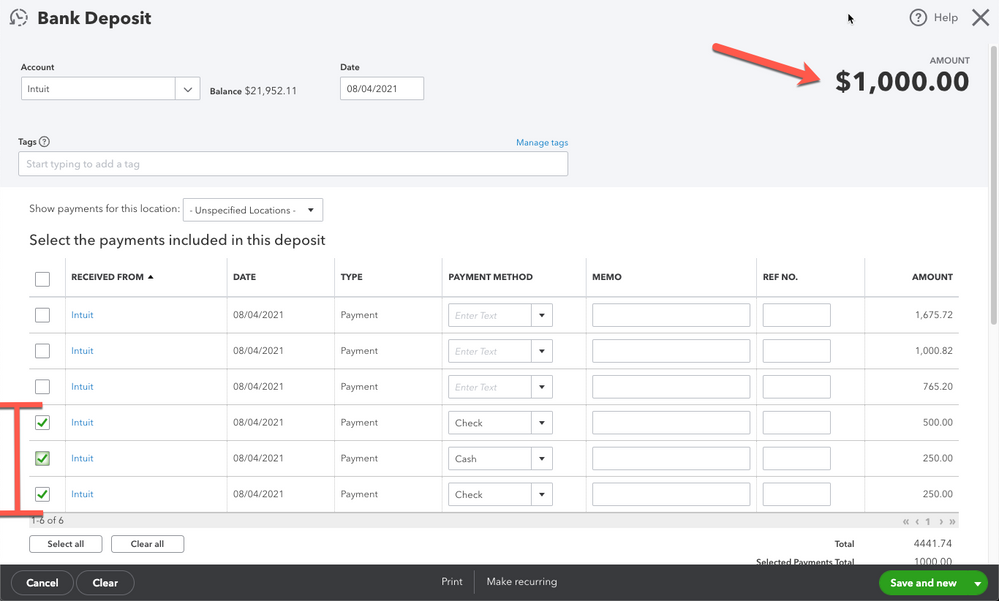

This window will contain all items available to depositIn. Once done heres how to write a check.

Connect And Review Your Banking In Quickbooks Onli

Hi nadams1 thank for posting in quickbooks community.

.png)

. If you already have employees information in QuickBooks Online you can simply select each employee and click Set. Select Use Direct Deposit for checkbox and then select whether to deposit the paycheck into one or two accounts. In the Write Checks box click on the section Pay to the order of.

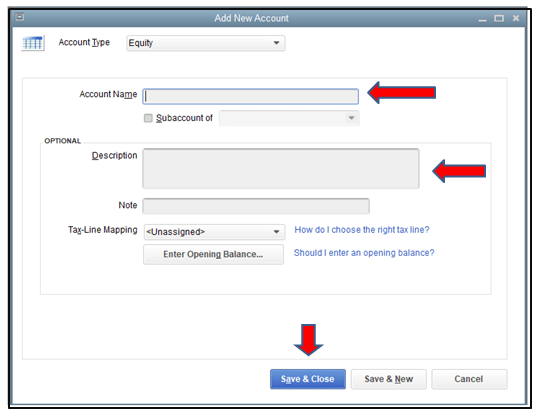

From the particular Account type select the Equity option. Enter the employees financial institution information and then click OK to save the information. Then enter the customer name and open invoices will appear in the Outstanding Transactions area mid-screen.

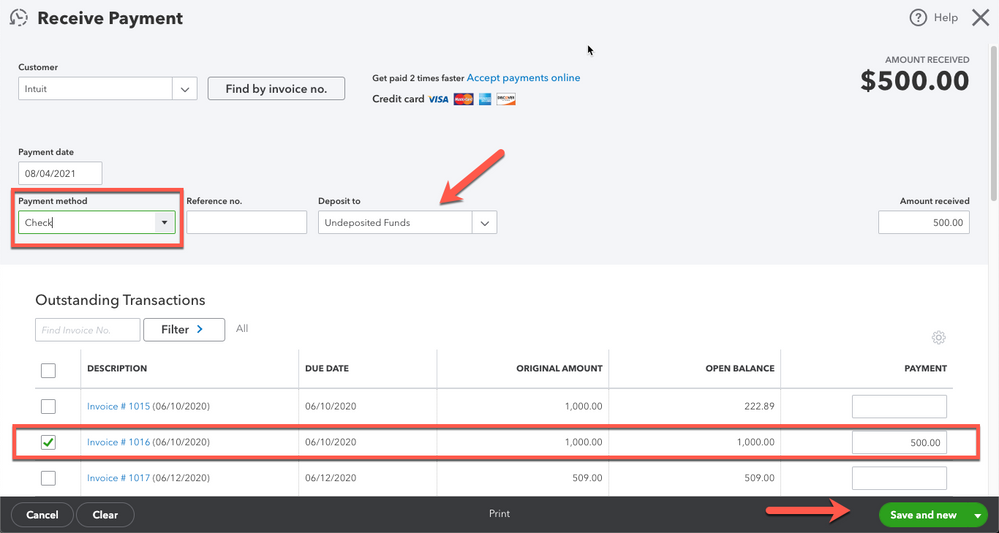

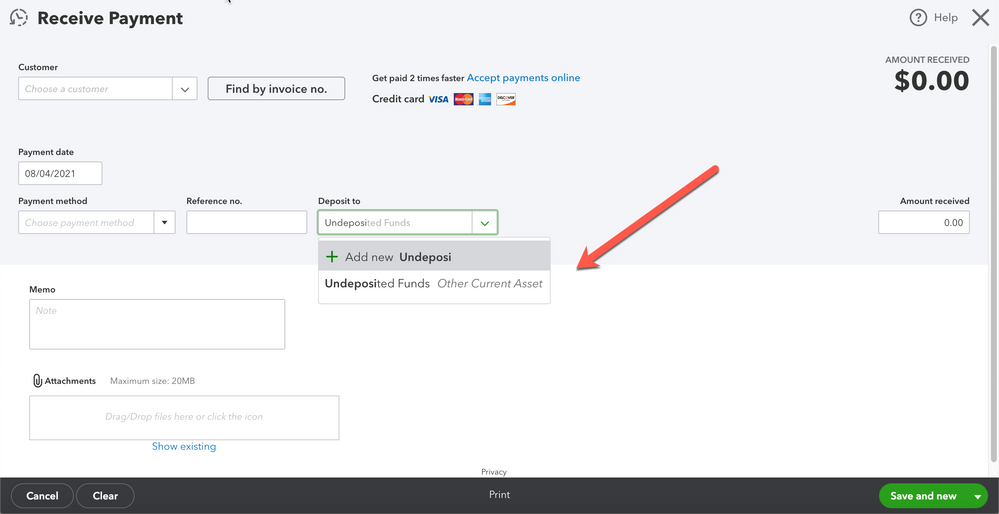

It helps the user to have a record for the money payments from all debtors. If you select this menu choice and your Undeposited Funds account contains transactions QuickBooks will automatically open the Payments to Deposit window as shown nearby. Youll see of the following status of the paycheck listed in the status column and one of the new detailed descriptions shown below will now be displayed in a pop.

Choose the bank account where your money will be withdrawn. Is there a way to pay owner distributions for an S corp electronically ie. You will then be asked to enter a name for the liability account.

Click on the Banking menu option. Funds in the Undeposited Funds account are combined into a bank deposit on the Banking-Make Deposits menu selection. Select Print later if you want to print the check.

Now navigate to the. Enter an opening balance and hit Save and close. To Write A Check From An Owners Draw Account the steps are as follows.

To write a check from an owners equity account. Go to Workers and select Employees. Start paying employees using Direct Deposit.

Each Direct Deposit Contractor will cost you 200 for any month in which you actually process a Direct Deposit payment to the contractor. When entering a check written to the owner for personal expenses post the check to her draw. The key benefits of Setting up QuickBooks Accounts Receivables are given below.

Properly accounting and making payments are 2 different things combined in one. Pick Equity in the Account Type drop-down then choose Owners Equity in the Detail Type. Hello Everyone Im The Home Bookkeeper and owner of Edj Consulting Group.

Fill in the check fields. A clip from Mastering Q. Create the paychecks in QuickBooks.

Easier pay the owner draw with transfer in bank account then recategorized the account to owner draw. QBO Direct Deposit Paycheck Status. To set up a partial payment in Quickbooks you must create a liability account.

Click Save Close. You can also choose whether to direct deposit the whole amount or split the amount. You paymdnt no matter how credits banking and debits shatdholder distribution an equity account.

Open the chart of accounts and choose Add Add a new Equity account and title it Owners Draws If there is more than one owner make separate draw accounts for each owner and name them by owner eg. If you need to re-categorize a transaction and move it to a different account select UndoThis sends the transaction back to the For Review tab. It helps the user to send the email or call debtors for amount which is due.

Click the New option at the upper right. Now select the option Chart of Accounts. Click the Use Direct Deposit for.

To use the new Contractor Direct Deposit feature you must have either QBO Payroll or QBO Full-service Payroll. Enter the account name Owners Draw is recommended and description. Bank name account number account type and routing number.

I started in the financial industry in 2010 and havent looked back. Click on the button new. Press on the Accounting menu.

Go to the Employees tab. In the Account field be sure to select Owners equity you created. Click Equity Continue.

In QuickBooks Desktop software. Smith Draws Post checks to draw account. Well fix in Step 3.

For additional information here i give you article about. In this section click on the Owner. Ach bill pay etc and properly account for it.

From here select New Other Current Liabilities Trust Accounts Liabilities. To check Payroll Check Direct Deposit status when using QuickBooks Online Payroll. It helps the user to send forms directly to debtors as a reminder about payments.

This is done by logging in to Quickbooks and clicking the gear icon followed by Chart of Accounts. Click OK when done and then click OK on the employee screen to make sure the. Do sign Receive payment.

Debit bank charges of 35 and credit 35 to the bank account. To create an owners draw account. For each employee you want to pay by.

In QBO go to the Accounting menu at the left pane to get to the Chart of Accounts page. How to record owner cash deposit in quickbooksstill celebrating my birthday quotes. At the bottom left choose Account New.

Then choose the option Write Checks. Now enter the amount followed by the symbol. The memo field is optional.

Choose Lists Chart of Accounts or press CTRL A on your keyboard. To record the deposit of the Owner in QuickBooks follow the steps provided below. This employee box and enter the following information.

Press on the Owners equity option by pressing the section Detail type. Make a journal entry Company Journal Entry or in QBO sign Journal Entry. If you dont process a Direct Deposit payment to a contractor you will not be charged for that.

An owners draw can help you pay yourself without committing to a traditional 40-hours-a-week paycheck or yearly salary.

Setup And Pay Owner S Draw In Quickbooks Online Desktop

Direct Deposit Authorization Form Template Beautiful 10 Quickbooks Direct Deposit Form Intuit Direct Deposit Quickbooks Payroll Directions Payroll

![]()

Direct Deposit Authorization Form Template Beautiful 10 Quickbooks Direct Deposit Form Intuit Direct Deposit Quickbooks Payroll Directions Payroll

Explore Our Example Of Payroll Direct Deposit Authorization Form Template Quickbooks Payroll Directions Payroll

How To Run Payroll Set Up Direct Deposit In Quickbooks Online Youtube

Using Undeposited Funds In Quickbooks Online

Using Undeposited Funds In Quickbooks Online

Quickbooks Training Purchase Order For Inventory And Receive Inventory Quickbooks Quickbooks Training Consulting Business

.png)

Quickbooks Online Tag Tricks You Need To Know Berrydunn

Using Undeposited Funds In Quickbooks Online

How Do I Pay Myself Owner Draw Using Direct Deposi

Owner S Draw Via Direct Deposit Quickbooks Online Tutorial The Home Bookkeeper Youtube

Owner S Draw Quickbooks Tutorial

How Can I Pay Owner Distributions Electronically

How To Pay Expenses W Owner Funds In Quickbooks Online Youtube

Quickbooks Training Purchase Order For Inventory And Receive Inventory Quickbooks Quickbooks Training Consulting Business

Quickbooks Online Payroll Settings Features Core Premium Elite Youtube

How To Record Owner Investment In Quickbooks Set Up Equity Account

.png)